Hawaii, with its stunning landscapes, vibrant culture, and year-round tropical weather, is a dream destination for many. However, the cost of living in Hawaii is often a topic of concern for those considering a move to the islands. From housing and groceries to transportation and utilities, the expenses can be significantly higher than the national average. Understanding the financial realities of living in Hawaii is essential for anyone planning to relocate or simply curious about life in paradise.

Living in Hawaii offers unparalleled beauty and a unique lifestyle, but it comes at a price. The state's remote location in the Pacific Ocean contributes to higher costs for imported goods, while limited land availability drives up housing prices. Whether you're a retiree, a working professional, or a family looking to settle down, it's crucial to evaluate how the cost of living in Hawaii aligns with your budget and lifestyle goals. This guide will provide a detailed breakdown of the expenses you can expect and tips for managing them effectively.

Beyond the numbers, the cost of living in Hawaii also reflects the island's rich culture and natural resources. While the financial aspect may seem daunting, many residents find the trade-off worthwhile for the unparalleled quality of life. From breathtaking beaches to a strong sense of community, Hawaii offers intangible benefits that go beyond monetary value. In the following sections, we’ll explore the key factors contributing to Hawaii's cost of living and provide actionable insights to help you make an informed decision.

Read also:Victoria Chlebowski A Rising Star In Modern Media And Beyond

Table of Contents

- Is Hawaii Expensive to Live In?

- What Are the Main Factors Affecting the Cost of Living in Hawaii?

- How Does Housing Cost in Hawaii Compare to the Mainland?

- What Are the Average Monthly Expenses for a Family in Hawaii?

- Can You Save Money While Living in Hawaii?

- Groceries and Dining Out in Hawaii

- Transportation Costs in Hawaii

- Utilities and Other Essential Expenses

- How to Budget for the Cost of Living in Hawaii

- Final Thoughts on the Cost of Living in Hawaii

Is Hawaii Expensive to Live In?

Hawaii consistently ranks as one of the most expensive states in the United States. The high cost of living in Hawaii is driven by several factors, including its geographic isolation, limited land availability, and reliance on imported goods. For example, nearly 90% of the food consumed in Hawaii is imported, which significantly increases grocery prices. Additionally, housing costs are among the highest in the nation, with median home prices often exceeding $1 million in popular areas like Oahu and Maui.

Despite these challenges, many residents find ways to adapt and thrive in Hawaii. The state offers a unique blend of natural beauty, cultural richness, and a laid-back lifestyle that many consider priceless. However, it's essential to weigh the pros and cons before making the move. Are you prepared to adjust your spending habits to accommodate the cost of living in Hawaii?

What Are the Main Factors Affecting the Cost of Living in Hawaii?

Several key factors contribute to the high cost of living in Hawaii. First and foremost is housing, which accounts for a significant portion of monthly expenses. The limited availability of land and high demand for properties drive up prices, making it difficult for many residents to afford homeownership. Renters also face steep costs, with average monthly rents often exceeding $2,500 for a two-bedroom apartment in urban areas.

Another major factor is the cost of groceries and everyday essentials. Since most goods must be shipped from the mainland, prices for fresh produce, meat, and other staples are significantly higher than the national average. Transportation costs are also a concern, as gas prices in Hawaii are typically among the highest in the country due to shipping fees and taxes.

How Does Housing Cost in Hawaii Compare to the Mainland?

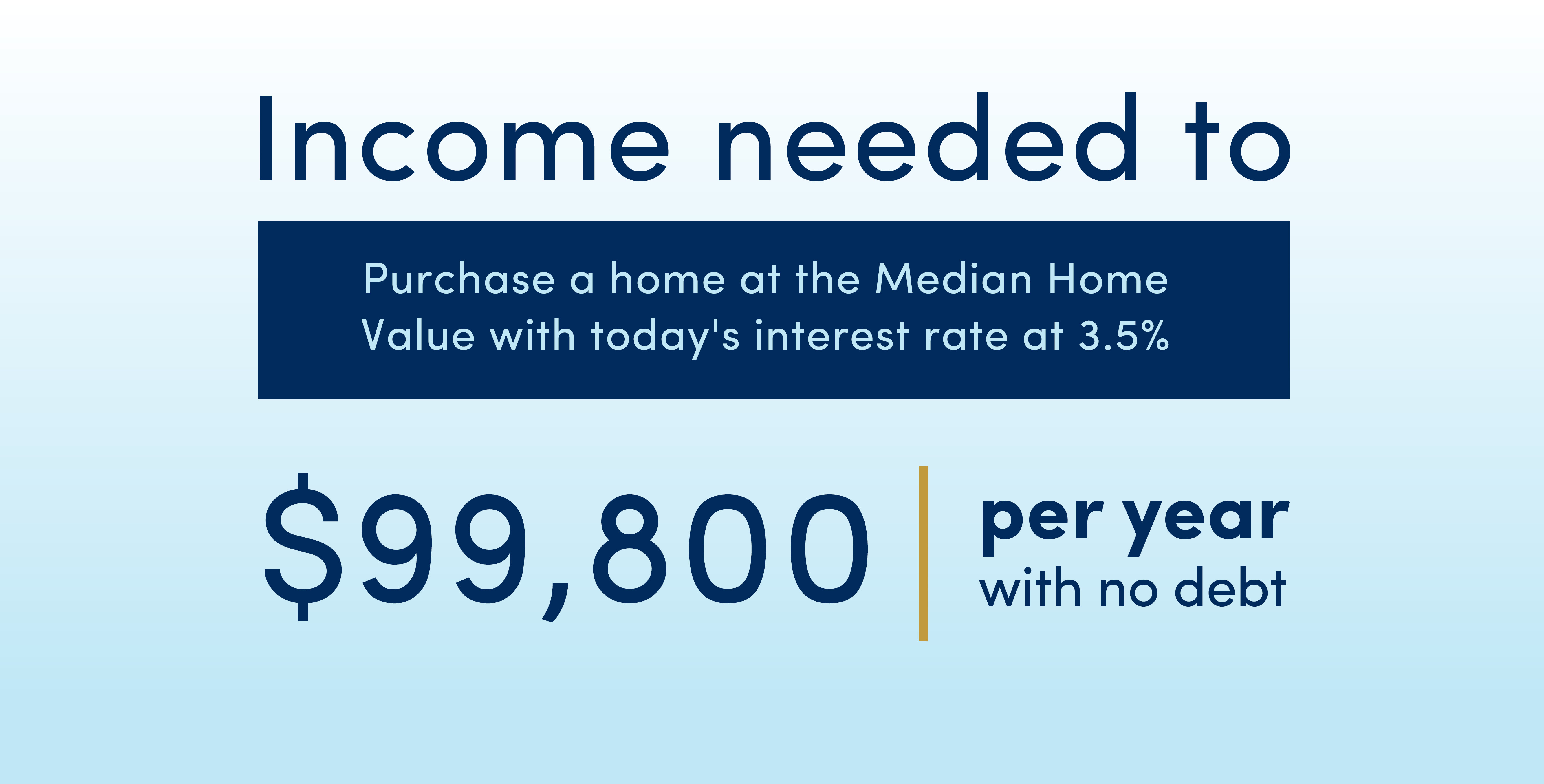

The housing market in Hawaii is notoriously competitive, with prices far exceeding those on the mainland. For example, the median home price in Honolulu is often double or triple that of cities like Austin or Denver. This disparity is due to Hawaii's limited land availability and strict zoning laws, which restrict new developments and exacerbate the housing shortage.

For renters, the situation is equally challenging. A one-bedroom apartment in downtown Honolulu can cost upwards of $2,000 per month, while similar units in smaller towns may still exceed $1,500. Prospective residents should carefully consider their housing options and explore alternative solutions, such as shared living arrangements or relocating to less expensive islands like the Big Island.

Read also:Anissa Jones The Life And Legacy Of A Child Star

What Are the Average Monthly Expenses for a Family in Hawaii?

Living in Hawaii as a family requires careful financial planning due to the high cost of living. On average, a family of four can expect to spend approximately $6,000 to $8,000 per month on essentials such as housing, food, transportation, and utilities. Housing typically accounts for the largest portion of the budget, followed by groceries and healthcare.

To give you a clearer picture, here’s a breakdown of average monthly expenses for a family in Hawaii:

- Rent: $2,500–$3,500 for a three-bedroom apartment

- Groceries: $1,200–$1,500

- Utilities: $300–$400

- Transportation: $500–$700 (including gas and car maintenance)

- Healthcare: $800–$1,000 (depending on insurance coverage)

Can You Save Money While Living in Hawaii?

While the cost of living in Hawaii is undeniably high, there are ways to save money and stretch your budget. One effective strategy is to take advantage of local resources, such as farmers' markets, where fresh produce is often more affordable than at grocery stores. Additionally, many residents grow their own fruits and vegetables, reducing their reliance on imported goods.

Another way to save is by minimizing transportation costs. Public transit options like buses are relatively affordable, and biking or walking is feasible in many areas. For those who own a vehicle, carpooling or using rideshare services can help reduce gas expenses. Finally, consider exploring free or low-cost recreational activities, such as hiking, beach visits, and community events, to enjoy Hawaii's natural beauty without breaking the bank.

Groceries and Dining Out in Hawaii

One of the most noticeable aspects of the cost of living in Hawaii is the price of groceries. Basic items like milk, bread, and eggs can cost 50–100% more than on the mainland. Imported goods, such as certain fruits, vegetables, and specialty items, are even more expensive. To manage these costs, many residents shop at local markets, join co-ops, or participate in community-supported agriculture (CSA) programs.

Dining out in Hawaii is also a luxury. A meal at a mid-range restaurant can cost $20–$40 per person, while fine dining experiences can easily exceed $100 per person. However, there are plenty of affordable options, such as food trucks, plate lunch spots, and local eateries, where you can enjoy authentic Hawaiian cuisine without overspending.

Transportation Costs in Hawaii

Transportation is another significant expense for residents of Hawaii. Gas prices are consistently higher than the national average, often reaching $4–$5 per gallon. Owning and maintaining a vehicle is a necessity for most people, as public transportation options are limited outside of urban areas.

To reduce transportation costs, consider using rideshare services, carpooling, or opting for fuel-efficient vehicles. Additionally, some islands offer bike-friendly infrastructure, making cycling a viable alternative for short commutes. For those who frequently travel between islands, budget airlines like Southwest offer competitive rates, making inter-island travel more affordable.

Utilities and Other Essential Expenses

Utilities in Hawaii, including electricity, water, and internet, are generally higher than the national average. Electricity rates are particularly steep due to the state's reliance on imported oil for power generation. However, many residents are transitioning to solar energy to reduce their utility bills.

Other essential expenses, such as healthcare and education, also contribute to the overall cost of living in Hawaii. Health insurance premiums can be high, but government programs and employer-sponsored plans may help offset some costs. For families with children, private school tuition is another significant expense, with annual fees ranging from $10,000 to $30,000 per child.

How to Budget for the Cost of Living in Hawaii

Budgeting effectively is crucial for managing the cost of living in Hawaii. Start by creating a detailed monthly budget that accounts for all essential expenses, including housing, groceries, utilities, and transportation. Prioritize needs over wants and look for ways to cut costs, such as shopping locally or reducing energy consumption.

Consider setting aside a portion of your income for savings and emergencies. Given the high cost of living, having a financial safety net is especially important in Hawaii. Additionally, explore local resources and programs that offer financial assistance or discounts for residents, such as housing subsidies or utility rebates.

Final Thoughts on the Cost of Living in Hawaii

Living in Hawaii offers a unique and rewarding experience, but it comes with a high price tag. The cost of living in Hawaii is influenced by factors such as housing, groceries, transportation, and utilities, all of which are significantly higher than the national average. However, with careful planning and smart financial decisions, it’s possible to enjoy the island lifestyle without overspending.

Ultimately, the decision to move to Hawaii should be based on more than just the cost of living. The state’s natural beauty, rich culture, and strong sense of community make it a special place to call home. By understanding the financial realities and preparing accordingly, you can make the most of your time in paradise while staying within your budget.